In today’s fast-paced world, technology continues to reshape various industries, and the insurance sector is no exception. One of the most innovative and transformative technologies in this field is the use of drones for imaging and video documentation. As insurance companies strive to streamline processes and enhance accuracy, drones have emerged as a game-changing tool. Among the leaders in this domain is Eagle Eye UAS Services, a company dedicated to providing top-notch drone imaging and video solutions for home and business insurance documentation.

The Emergence of Drone Technology in Insurance

Traditionally, insurance documentation has been a labor-intensive process involving manual inspections, extensive paperwork, and subjective assessments. This method often leads to inconsistencies, delays, and potential errors. However, the advent of drone technology has brought about a significant shift. Drones, also known as Unmanned Aerial Systems (UAS), are equipped with high-resolution cameras and advanced sensors that can capture detailed images and videos from various angles and heights.

Benefits of Using Drones in Insurance Documentation

- Enhanced Accuracy and Detail Drones can capture high-resolution images and videos that provide a comprehensive view of properties. This level of detail is often unattainable through traditional methods. For instance, Eagle Eye UAS Services utilizes state-of-the-art drones equipped with 4K cameras and thermal imaging sensors to ensure that every aspect of a property is meticulously documented. This accuracy is crucial for underwriting and claims processing, as it reduces the likelihood of disputes and ensures fair evaluations.

- Time Efficiency Manual inspections can be time-consuming, particularly for large or complex properties. Drones can cover vast areas in a fraction of the time it takes for human inspectors. This efficiency is a significant advantage for both insurance companies and policyholders. Eagle Eye UAS Services prides itself on its rapid deployment and quick turnaround times, enabling insurers to expedite their processes and provide timely responses to clients.

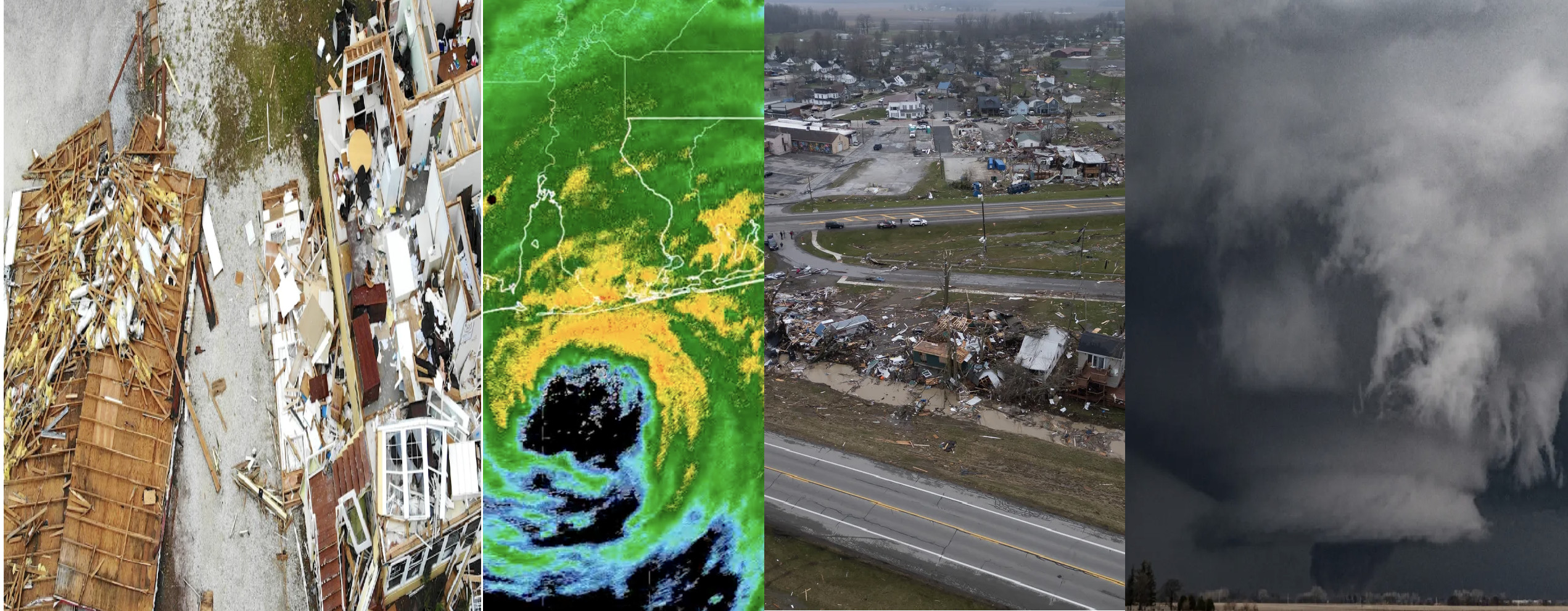

- Safety Inspecting damaged or hazardous properties poses significant risks to human inspectors. Drones can access hard-to-reach areas, such as rooftops, tall structures, and disaster-stricken zones, without putting anyone in harm’s way. This capability is especially valuable in the aftermath of natural disasters, where quick and safe assessments are essential.

- Cost-Effectiveness While there is an initial investment in drone technology, the long-term cost savings are substantial. Reduced labor costs, minimized travel expenses, and faster processing times all contribute to a more cost-effective insurance documentation process. Eagle Eye UAS Services offers competitive pricing models that cater to the specific needs of insurance companies, making drone services an affordable option for insurers of all sizes.

Applications in Home Insurance

Home insurance relies heavily on accurate property assessments to determine coverage and premiums. Drones offer a range of applications in this area:

- Pre-Underwriting Inspections Before issuing a policy, insurers need a thorough understanding of the property’s condition. Drones can provide a complete overview, highlighting potential risks such as roof damage, structural issues, or landscaping concerns. This information allows underwriters to make informed decisions and offer tailored coverage.

- Claims Adjustments In the event of a claim, quick and accurate assessments are crucial. Drones can rapidly document damage, providing clear evidence that supports the claims process. This speed not only enhances customer satisfaction but also reduces the likelihood of fraudulent claims.

- Routine Inspections Periodic inspections are essential for maintaining accurate records and adjusting coverage as needed. Drones enable insurers to conduct these inspections efficiently, ensuring that policies remain up to date and reflective of the property’s current condition.

Applications in Business Insurance

For businesses, particularly those with large or complex properties, drone technology offers even more significant benefits:

- Commercial Property Assessments Large commercial properties, such as warehouses, factories, and office buildings, require detailed inspections to evaluate risks and determine appropriate coverage. Drones can capture comprehensive images and videos of these properties, highlighting potential hazards that might be missed during manual inspections.

- Disaster Response In the aftermath of natural disasters, businesses need swift assessments to initiate recovery efforts. Drones can quickly survey the extent of damage, providing insurers with the data needed to process claims and support their clients in rebuilding efforts. Eagle Eye UAS Services has a proven track record of deploying drones in disaster-stricken areas, offering invaluable support to insurance companies and policyholders.

- Risk Management Ongoing risk management is essential for businesses to minimize potential losses. Drones can conduct regular inspections, identifying issues such as roof damage, water leaks, or structural weaknesses. By addressing these problems proactively, businesses can reduce the likelihood of significant claims and maintain favorable insurance premiums.

Real-World Examples

Several companies have already recognized the value of drone technology in insurance documentation:

- State Farm State Farm, one of the largest insurance providers in the United States, has integrated drone technology into its claims process. The company uses drones to inspect rooftops and assess damage after storms, reducing the time required for claims processing and improving accuracy .

- Allstate Allstate has also embraced drone technology, particularly in the aftermath of natural disasters. The company uses drones to quickly assess damage and provide real-time data to adjusters, enabling faster claims resolution and supporting policyholders during critical times .

- Farmers Insurance Farmers Insurance utilizes drones for both underwriting and claims purposes. The company has reported significant improvements in efficiency and accuracy, allowing them to provide better service to their clients .

Eagle Eye UAS Services: Leading the Way

Eagle Eye UAS Services stands out as a premier provider of drone imaging and video solutions for the insurance industry. With a team of experienced pilots and advanced drone technology, the company offers a range of services tailored to meet the specific needs of insurance companies.

- Customized Solutions Eagle Eye UAS Services understands that every insurance company has unique requirements. The company works closely with clients to develop customized solutions that address their specific needs, whether it’s for pre-underwriting inspections, claims adjustments, or routine inspections.

- Advanced Technology The company utilizes the latest drone technology, including 4K cameras, thermal imaging, and GPS capabilities, to ensure that every detail is captured accurately. This commitment to using cutting-edge technology sets Eagle Eye UAS Services apart from competitors.

- Professional Team Eagle Eye UAS Services boasts a team of certified drone pilots with extensive experience in the insurance industry. Their expertise ensures that every project is executed with precision and professionalism, delivering reliable results that insurance companies can trust.

- Nationwide Coverage With a network of pilots across the country, Eagle Eye UAS Services can provide rapid response and consistent service to insurance companies nationwide. This extensive coverage is particularly valuable in the aftermath of natural disasters, where timely assessments are critical.

Conclusion

The integration of drone imaging and video technology into the insurance industry marks a significant advancement in how properties are documented and assessed. Companies like Eagle Eye UAS Services are at the forefront of this transformation, providing innovative solutions that enhance accuracy, efficiency, and safety. As more insurance companies recognize the benefits of drone technology, it is poised to become an essential tool in the industry, revolutionizing the way home and business insurance documentation is conducted.

By leveraging the capabilities of drones, home owners can protect themselves with high definition images and video. And, insurance companies can streamline their processes, reduce costs, reduce liability, and provide better service to their clients. The future of insurance documentation is undoubtedly in the skies, and with leaders like Eagle Eye UAS Services, the transition is well underway.

eeuass@gmail.com

eeuass@gmail.com

Leave a Reply